Buying a condo as a first home is a great and affordable idea. Here's what you need to know.

Published on 01/25/2023

If you're a first-time homebuyer, it's essential that you arm yourself with knowledge. This is what most buyers wish they knew beforehand.

Published on 01/18/2023

Use these tips to help you get your finances in order before buying your first home.

Published on 01/11/2023

Should you buy a new construction or an existing home? We're discussing the pros of each.

Published on 01/04/2023

Confused by real estate and mortgage news headlines? Learn where to find honest advice and guidance for all your mortgage questions.

Published on 12/28/2022

We're spilling the beans on whether getting pre-approved for a mortgage lowers your credit score.

Published on 12/21/2022

Learn about the benefits of working with a mortgage professional and how it can save you money.

Published on 12/14/2022

Need some extra cash? Your home equity is a powerful tool you can use to get the cash you need.

Published on 12/07/2022

Multigenerational living is increasing in popularity. It also has many perks! See how to make it work for you.

Published on 11/30/2022

Do you have a unique circumstance? These home loan options may be the right fit.

Published on 11/24/2022

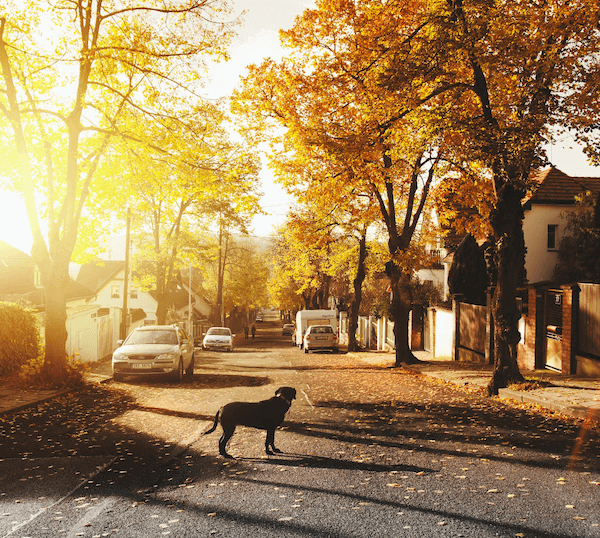

What you need to look for when looking to buy a home in a new neighborhood.

Published on 11/16/2022

Here are the top tips for adding instant curb appeal to your home --without breaking the bank!

Published on 11/09/2022

Here's how to choose a new city when you want to relocate.

Published on 11/02/2022

Review the fastest (and easiest) ways to raise your credit score before applying for a home loan.

Published on 10/26/2022

Is buying a home still worth it in 2022? Yes! Learn why.

Published on 10/19/2022

These tips can save your tons and make it possible to buy your first home sooner rather than later.

Published on 10/12/2022

Here are the signs that 2022 will be a buyers market

Published on 10/05/2022

Learning to navigate the 2022 housing market as a homebuyer.

Published on 09/28/2022

Buying your first home? Look out for these potential problems.

Published on 09/21/2022

Check out these tips for getting a great deal on your home even in a seller's market.

Published on 09/14/2022